Cash Flow Management: A Guide for Small Businesses

For any small business owner, the phrase “cash is king” isn’t just a cliché—it’s also a daily reality. Strong sales figures on paper, for instance, don’t guarantee success if there isn’t enough cash in the bank to cover daily expenses. That’s where effective cash flow management comes in. By actively controlling the money moving in and out of your business, you can therefore ensure financial stability, make smart decisions, and build a more valuable company for the future. This guide provides practical strategies to help you master your company’s cash flow.

1. The Importance of Positive Cash Flow

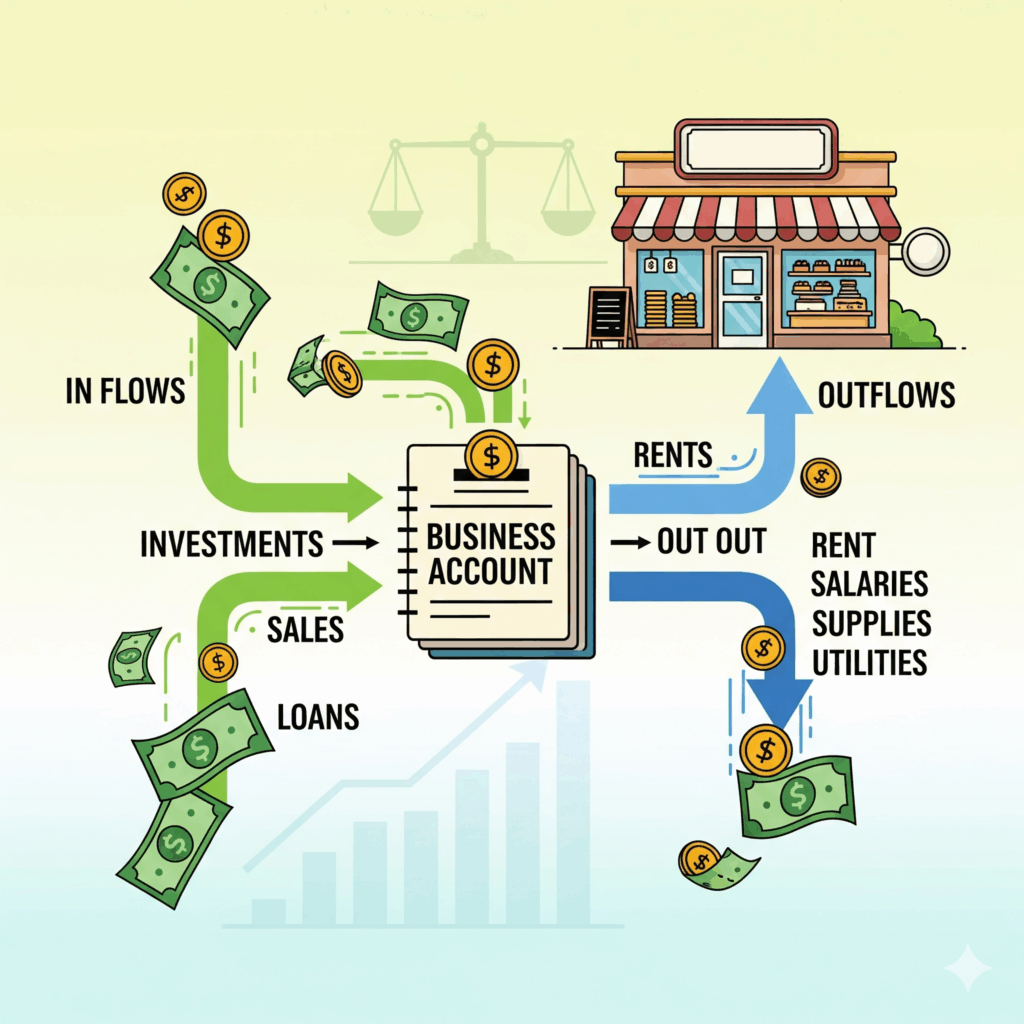

Cash flow refers to the net amount of cash and cash equivalents being transferred into and out of a business. First and foremost, positive cash flow means your company’s liquid assets are increasing, which is vital for covering operating costs, investing in growth, and handling unexpected expenses. Consequently, a business with strong and consistent cash flow is not only more resilient but also significantly more attractive to potential investors or buyers.

2. Strategies for Managing Incoming Cash

The primary goal is to get money into your business faster. These tactics can help you accelerate your cash inflow and improve your financial position.

- Speed Up Invoicing: Send invoices as soon as the work is completed or the product is shipped. The faster you bill, after all, the faster you get paid.

- Offer Early Payment Discounts: Encourage clients to pay their bills early by offering a small discount (e.g., “2% off if paid within 10 days”).

- Follow Up on Overdue Payments: Be persistent and systematic in following up on late payments. A clear and polite follow-up process, moreover, can make a big difference.

3. Strategies for Managing Outgoing Cash

Controlling what goes out is just as important as getting money in. A careful approach to spending can therefore free up valuable cash.

- Negotiate Better Payment Terms: Talk to your suppliers about extending payment terms. Getting 30 or 60 days to pay instead of 15, for example, can significantly improve your cash position.

- Review Expenses Regularly: Conduct a monthly or quarterly review of all your expenses. In doing so, identify non-essential costs that can be reduced or eliminated.

- Control Inventory: For businesses that manage physical goods, holding excess inventory ties up cash. Consequently, use forecasting to avoid overstocking and keep inventory lean.

4. Forecasting Your Cash Flow

A cash flow forecast is a forward-looking tool that helps you predict how much cash you will have in the future. It allows you to anticipate potential shortfalls and take action before they become a problem. For a clear definition of what cash flow is, you can read more on Investopedia.

- Create a Simple Spreadsheet: List all expected cash inflows and outflows on a weekly or monthly basis. Be realistic with your numbers.

- Scenario Planning: Run different scenarios. What happens if a major client pays late? Or if you have a sudden large expense? This helps you prepare for the unexpected.

Want to Learn More About Your Business Value?

In conclusion, mastering your cash flow is a crucial step in building a financially strong and valuable business. A company with healthy cash flow, in fact, is far more attractive to investors and potential buyers. For a deeper understanding of your company’s overall health and value, explore the resources on Bisvalue.com. We provide data-driven valuations and detailed business information to help you make informed decisions about your company’s future.